When we hear about financial freedom the first thought inevitably goes to money. Always the money generates ambivalent feelings, if not contradictory, in each of us. On one side, we want the comforts and security that it can guarantee us; on the other, we think that financial enrichment corrupts our ethics and moral integrity. The idea that the rich are corrupt and that you can't stay honest to make money is more and more consolidated. Cinema has also contributed to a negative vision of material wealth: who remembers a film in which the “good guy” on duty was a rich man?

The Bible tells us that "love of money is the root of all evil". Often, however, this phrase is misrepresented and presented in a slightly different way by omitting the first two words: "money is the root of all evil". There is obviously a big difference between the two expressions! I agree with the first, but not with the second. It's clear that if money becomes a "passion" and material wealth is avidly pursued without other values or to their detriment, you lose. But the financial freedom, conquered honestly and respecting other values, it cannot be condemned in any way.

It is good to have money and the things that money can buy, but it is also good, every now and then, to check and be sure that you have not lost the things that money cannot buy.

George Horace Lorimer

I think that every activity we carry out must be aimed at get the best possible results. If we dedicate ourselves to paid work, isn't it something laudable to try to accomplish all we can? Not expressing oneself to the fullest of one's abilities and potential is always negative. The other way around, expressing one's resourcefulness in terms of productivity, including financial freedom, is always positive. If we want, it is the very essence of life: we are creatures who create and transform themselves continuously. Of course it is not the amount of money we manage to earn that matters, but rather being able to do everything we can with our abilities. AND to best express our financial capabilities we must have a plan so that we allocate the money in the correct way.

The lack of a teaching of the economics of everyday life (I do not mean theoretical but practical economics) in schools is a serious omission of the education system. This is the reason why even educated and established people (doctors, lawyers, managers and even entrepreneurs) they have no notion of how to manage their money. The daily economy is one that allows people to become financially independent in a constant, continuous and always predictable way. Financial freedom is an immense achievement!

Powerful is financial education. Money comes and goes, but those who are educated on their management can get rich.

Robert Kiyosaki

Financial freedom through the 70/30 rule

How to use 70% of your income to get financial freedom

We assume that, whether we like it or not, we all have to pay taxes. When we buy a good, the price we pay includes VAT, and this is already a form of tax that anyone pays, willy-nilly. There are civil servants who pay taxes through withholding and entrepreneurs who file their tax returns. After you have paid your fair share of taxes, you must learn to live on the basis of 70% of your net income. In short, this 70% should be allocated to necessary and discretionary expenses. Carefully observe your lifestyle in relation to your income and check monthly how much you spend: if it is more than 70% of your income you are committing a slow financial "suicide". Your next installment purchase could be a dose of poison served to you on a silver platter. If you want to safeguard yours financial freedomtherefore, be extremely careful with installment purchases.

How to use the remaining 30% of your income to protect and enhance financial freedom

Capital investments or doing business

30% unspent, a third party should be employed to purchase, repair, produce or sell. It is a question of making a so-called "capital investment". The secret is to run a small business, even if only part time, perhaps using the online channel. There are creatives who sell their creations (paintings, costume jewelery, embroidery, accessories and household items) on the internet and others, less creative, who buy collectibles in Sunday morning markets and then resell them, again on the internet. Free enterprise has no limits, you could also undertake a more "serious" business, this depends on the investments you can make with 10% of your income. The important thing is to always try to generate a profit even in addition to your main job, putting a lot of imagination into it. Think about what your hobbies are and see if you can turn them into a business, even a small one. You may have real estate or land that is not in use; think about how you can re-evaluate them and then resell them to you. Perhaps over time what started as a side business could become a very profitable business, and make your fortune. In short, yours financial freedom it could also hide in those activities that today you ignore or ignore.

The savings

Another 10% of your income should go to savings. This is one of the more inspiring things than your plan for wealth and financial freedom, since it can give you peace of mind and tranquility in view of the "winters" of life. To make sure you can save 10% of your income month by month, the ideal would be that subscribed to an investment plan so that in the future you can have a sum increased by the rate of return. If you really don't want to "commit" your money to a financial investment, you can also self-manage your savings, trying to deposit 10% of your net income into your current account without spending it.

Charity

Finally, the remaining 10% of your net income should go to charities and therefore go to charitable activities. Charity is a sublime act with which you can give back to the community what you have received. It is one way rewarding to enhance one's own financial freedom. Don't you feel spiritually well after giving? You see, greed pollutes the soul; and then always try to keep it away from your life. You must be grateful for what you have: for which don't skimp when it comes to giving. The gesture of giving should be taught since childhood: The best time to do this is when the child receives his or her first coin. Educate your child for charity: if there is a homeless man on the street, explain to him that he is a person in need who should be helped. If the child understands the importance of this, he will have no difficulty in depriving himself of a dime. Children have big hearts (much more than adults!); but we must also educate them to express generosity. If we all grew up to remain a bit 'children in what are the essential values of life (sincerity, generosity, love, goodness, genuineness) the world would be a better place.

Try to put the 70/30 rule into practice right away: by applying this formula consistently you will acquire your financial freedom, maybe not really in the very short term, but in a few years you will already appreciate the results. Let me give you a definition of "rich" and "poor". The poor are the ones who spend the money and save what's left. The rich, on the other hand, are the ones who save money and spend what is left over. The same sum of money, therefore, can be managed in opposing ways, and give completely different financial outcomes: poverty on the one hand, wealth on the other. Therefore, consider saving as something that has long-term effects. At the end of the day, week or month, the effects of saving are so subtle that they don't seem important. But over the years the differences become significant. After a decade, for example, the differences are noticeable and pronounced.

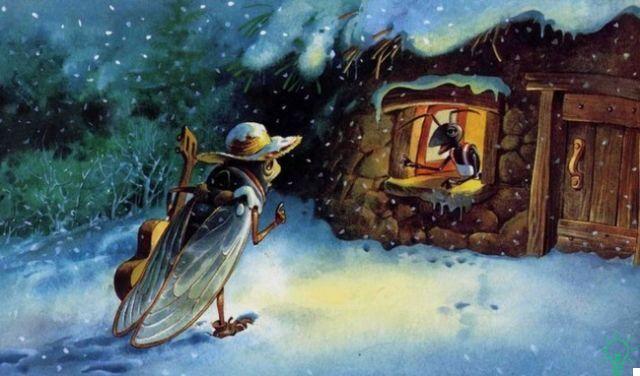

The tale of the cicada and the ant as a metaphor for financial freedom

An extraordinary lesson by financial freedom nature provides it to us. It is the "philosophy of the ant". Ants are amazing for two reasons. First of all they never give up! Try to get in the way of an ant; it does not stop, it simply goes around the obstacle and continues the path towards its goal. Ants are always looking for the right opening, whether it is above, below or beside the obstacle! They practically try to death. A second reason why they are exceptional is that these insects they plan their winters in the summer. During the summer the ants collect whatever they can collect. They are really smart and foresighted. Do you remember the tale of the cicada and the ant? The cicada made fun of the ants because while they worked hard to put the supplies aside, she was happily jumping in the tall grass without caring about the future. Then when the harsh winter came, the cicada died of hunger and the ants, on the other hand, lived in abundance.

Rich or poor is not so much a difference in what you earn; rather the difference lies in the how you use what you earn in order to achieve your financial freedom. The choice is yours: do you want to be cicada or ant?